INSURED, FULLY LICENSED, AND BONDED

INSURED, FULLY LICENSED, AND BONDED

Gutter Financing Made Simple

Financing Made Simple

Don’t let finances get in the way of much needed gutter repairs.

Don’t let finances get in the way of much needed gutter repairs.

(425) 449-6622

Need Our Services?

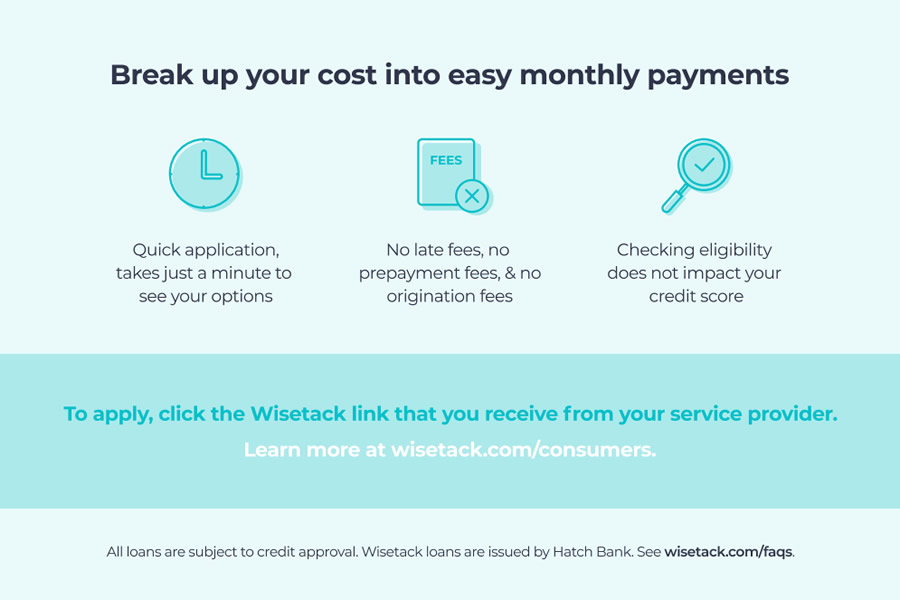

Consumer-friendly financing makes it easy to afford the services you care about. Now you can invest in what matters most without surprises or unexpected late fees.

Simple Financing Now Available Through Wisetack

- Short application, instant decision

- Checking your options does not affect your credit score

- Terms from 3 to 60 months

- APR from 0% to 35.9%

- No prepayment penalties, origination fees, or compounding interest

Contact us

Phone or Text (M-F, 7am-4pm PT): 1-833-927-0333

Email: [email protected]

Fast And Easy With No Hidden Fees

Frequently Asked Questions

Questions we get asked on a regular basis here at High Point Gutter headquarters.

Wisetack is a simple way to pay over time for a service or product. From home improvement projects to necessary repairs to your vehicle, Wisetack enables you to break up the cost of a purchase into easy monthly payments. When financing through Wisetack, checking your loan options does not impact your credit score (learn more here). And there are no prepayment fees, late fees, or compounding interest.

The application is initiated by the service provider and completed by you. On average, the application takes about a minute to complete. Once approved, you will receive several loan options to choose from—with various term lengths and monthly payment amounts.

When you take out a loan, Wisetack pays the service provider directly, and you pay us over time.

All loans subject to credit approval. Rates, terms, and conditions subject to change without notice. Some restrictions apply. Your rate may be higher based on your credit history and other qualifying criteria. Interest rates and monthly payment information are only estimates. Actual rates and monthly payment amounts are based on your personal credit history and will be provided upon receipt of a completed loan application that has been approved. For example, a $1,000 purchase could cost $45.18 a month for 24 months, based on a 7.9% APR.

Unfortunately, no. You need a mobile phone number in order to use Wisetack. For security purposes, we send you a verification code via SMS when accessing the application.

The rate you get with Wisetack may be lower than the rate your credit card company charges for maintaining a balance. Wisetack loans are simple interest, while credit cards charge compound interest. We don’t charge late fees, prepayment fees, or origination fees.

With Wisetack, you know exactly how much you will pay. Many people like knowing the exact monthly payment amount and find taking out a loan with a fixed term for a specific purpose may be more affordable than a credit card.

No. Unlike many lenders, Wisetack only requires a soft credit check. This means you can see and review your options without impacting your credit score.

You can learn about the difference between a soft versus hard credit check here.

It might. We report payment history to the credit bureaus. Paying back on time can have a positive effect on a credit score while paying late will have a negative effect. It’s easy to set up automatic payments to ensure on time payments and help build a positive credit history.

Checking your eligibility for a loan does not impact your credit score (learn more here).

There is no “one” credit score, as it turns out. The article below explains all the major factors that can account for variability in credit scores:

https://www.creditkarma.com/advice/i/why-credit-scores-differ-between-credit-reporting-agencies/

(note: Wisetack has no affiliation with Credit Karma)

You have the option to automate payments by linking your bank account while completing the loan application. If you choose to skip that step at the time of applying, but wish to step it up later, you will receive an email with instructions. The instructions will walk you through how to set up your online account. Once logged in to your account, you can choose to set up automatic ACH (bank-based) payments.

If you decide not to automate payments, you can also log in to pay manually or mail in a check each month. We do not accept credit cards as a form of payment.

No, linking your bank is not required in the application.

Even though it’s optional, we do recommend setting up automatic ACH (bank-based) payments, either during the application or after the loan is finalized, as it helps to ensure on-time payments. Building a history of on-time loan payments can be a good way to improve your credit score.

Absolutely! Simply log into your account and pay off your balance. We’ll never charge you a prepayment penalty.

Sure thing! We want to make the payment date work for your schedule. You will get an email shortly after taking out a loan from us, which will provide information on how to log in to your account where you can set up payments or change your payment date.

Feel free to email, call, or text us anytime! We’d be happy to answer your questions. Also, don’t hesitate to contact us with concerns.

Email: [email protected]

Call or text: +1-833-927-0333